Seller Closing Costs

Selling a home can be quite overwhelming, and it's natural to feel as if there is a lack of guidance available.

Below are standard fees associated with selling a property, and if you have any questions, specific or general - I am here to help.

Seller Closing Costs:

· Any Existing Liens, Pre-pays, Judgements, Taxes (pro-rated) , HOA fees, Bonds & Assessments . (Some of these may not be applicable)

· Real Estate Commissions : Typically this is 6% of the home’s final sale price and is split with the buyer’s agent.

· Title Search (This is typically paid for by the buyer) : Searches the property profile to ensure that there are no outstanding claims against the property, and if there are, that they are satisfied before the close of escrow.

· Title Insurance : There are two types of policies, the home buyer’s policy and the lender’s policy. Both policies protect either the home buyer or lender from unknown title claims. Negotiated.

· Escrow Fees : These fees are paid to the title and/or escrow company for miscellaneous services rendered, e.g. opening escrow, document preparation, notary, processing, recording, reconveyance preparation.

o These associated fees may increase if additional documentation, processing, recording, and notarial services are needed to handle additional liens, judgements, deeds, etc.

· Varied Inspection Reports . (As Applicable)

· Natural Hazard Zone Disclosure Statement .

· City Transfer Taxes: These are assessed by some cities and are typically a percentage ranging from ~1%-~2% of the sales price. This fee is usually split but i would refer you to county standards shown ,, here .

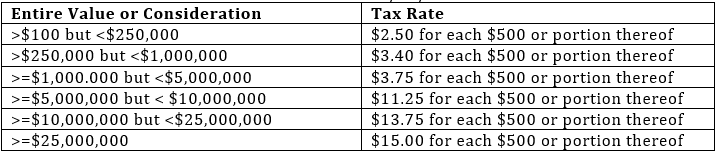

· County ,Transfer Taxes : These are taxes paid for transferring title of the home, and the current breakdown is as follows in San Francisco as of 10/23/2020. Every other county in California has a county transfer tax of $1.10 per $1,000 and this is Seller paid.

*The most recent rates and calculator can be found ,, here .

*The information provided on this website does not, and is not intended to, constitute legal or tax advice; instead, all information, content, and materials available on this site are for general informational purposes only. Information on this website may not constitute the most up-to-date legal or other information. This website may contain links to other third-party websites. Such links are only for the convenience of the reader, user, or browser.

Readers of this website should contact their attorney or tax accountant to obtain advice with respect to any particular legal or tax matter. Only your individual attorney or tax advisor can provide assurances that the information contained herein – and your interpretation of it – is applicable or appropriate to your particular situation.

The views expressed at, or through, this site are those of the individual author's writing in their individual capacity only. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided "as is;" no representations are made that the content is error-free.